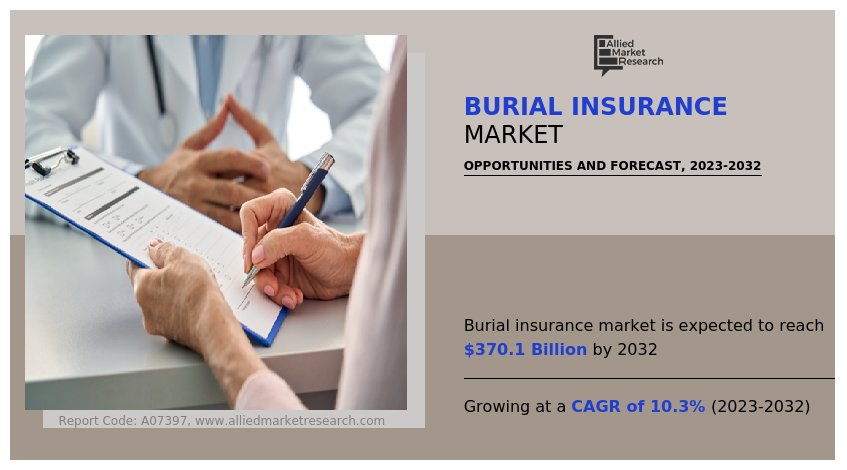

A recent report from Allied Market Research has been released under the title “Burial Insurance Market Size.” The report covers aspects such as different types of burial insurance (Simplified Issue, Guaranteed Issue, and Pre-need Insurance) and the age groups of end users (Over 50, Over 60, Over 70, and Over 80). The findings reveal that in the year 2022, the global burial insurance industry had a total revenue of $142.9 billion. Projections indicate a significant growth trajectory, with expectations for the industry to reach a substantial $370.1 billion by 2032. This growth is set to occur at a Compound Annual Growth Rate (CAGR) of 10.3% between the years 2023 and 2032.

Request PDF Brochure: https://www.alliedmarketresearch.com/request-sample/7762

Prime Determinants of Growth:

The global burial insurance market is experiencing growth due to factors such as the increase in the aging population, rising funeral costs, and increasing awareness and marketing efforts by burial insurance providers. On the other hand, limited awareness, changing preferences, and underwriting and eligibility requirements hampered the growth of the market to some extent. On the contrary, the increase in acceptance of burial insurance, technological advancements, and digital distribution channels have opened new opportunities for market growth.

COVID-19 Scenario-

- The COVID-19 pandemic had a positive impact on the burial insurance market. The pandemic led to a surge in deaths worldwide, creating a higher demand for burial insurance policies.

- However, the pandemic brought attention to the financial risks associated with unexpected deaths. People became more aware of the potential financial burden their families could face in terms of funeral expenses, outstanding debts, and other end-of-life costs. This awareness drove the demand for burial insurance to alleviate these financial concerns. This led to the rapid growth of the burial insurance market.

Buy This Report@ https://bit.ly/3pJZZpK

The guaranteed issue segment to maintain its leadership status throughout the forecast period-

Based on type, the guaranteed issue segment held the highest market share in 2022, accounting for nearly half of the global burial insurance market revenue, and is expected to maintain its leadership status throughout the forecast period. However, the same segment is projected to manifest the highest CAGR of 11.9% from 2023 to 2032, owing to the absence of a medical exam requirement. The application process for guaranteed-issue burial insurance is simple and straightforward. It involves answering a few basic questions about age, gender, and sometimes tobacco use. This ease of application makes it more accessible to a wider range of individuals, including older adults or those with limited mobility.

The over 60 segment to maintain its lead position throughout the forecast period-

By age of end user, the over 70 segment held the highest market share in 2022, accounting for more than one-third of the global burial insurance market revenue. On the other hand, the over 60 segment is estimated to maintain its lead position in terms of revenue throughout the forecast period, as it is relatively easier to obtain compared to traditional life insurance policies. Burial insurance policies for over 70 age groups are more affordable and have lower premium payments compared to other types of insurance coverage. However, the over 50 segment would showcase the fastest CAGR of 12.5% from 2023 to 2032. as the over 50 age group recognizes the need to plan to ensure that their funeral expenses are covered without burdening their close ones. Burial insurance has more relaxed underwriting standards compared to traditional life insurance policies. This makes it easier for individuals in the over 50 age group to qualify, even if they have pre-existing health conditions. The simplified application process and minimal medical requirements make burial insurance an attractive option for this demographic.

North America to maintain its dominance by 2032-

Based on region, North America held the highest market share in 2022, garnering around two-fifths of the global burial insurance market revenue, and is likely to dominate the market during the forecast period. owing to rising awareness regarding burial insurance coverage, an increase in the aging population, rising funeral costs, and growing marketing efforts. However, the Asia-Pacific region is expected to witness the fastest CAGR of 14.8% from 2023 to 2032. owing to the aging population, increasing awareness about end-of-life expenses, changing socioeconomic factors, rising healthcare costs, ease of access and customization of burial insurance policies, and government initiatives. These factors collectively contribute to the growing demand for burial insurance products in the region.

Leading Market Players: –

- Colonial Penn

- Globe Life and Accident Insurance Company

- Mutual of Omaha Insurance Company

- Progressive Casualty Insurance Company

- Foresters Financial

- State Farm Mutual Automobile Insurance Company

- Sentinel Security Life Inc.

- Fidelity Life Association

- Choice Mutual

- The Baltimore Life Insurance Company

The report provides a detailed analysis of these key players in the global burial insurance market. These players have adopted different strategies, such as new product launches, collaborations, expansion, joint ventures, agreements, and others, to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolios, and strategic moves of market players to showcase the competitive scenario.

Burial Insurance Market Key Segments:

By Type

- Simplified Issue

- Guaranteed Issue

- Pre-need Insurance

By Age of End User

- Over 50

- Over 60

- Over 70

- Over 80

No comments:

Post a Comment